Happy National Championship Tuesday! My prediction of the Tigers winning the game came true, and I’m sure all you funny guys and girls out there also felt the same way about your own predictions (for those that aren’t aware, both teams’ mascots were the Tigers.) And for those

Tag: Chart of the Week

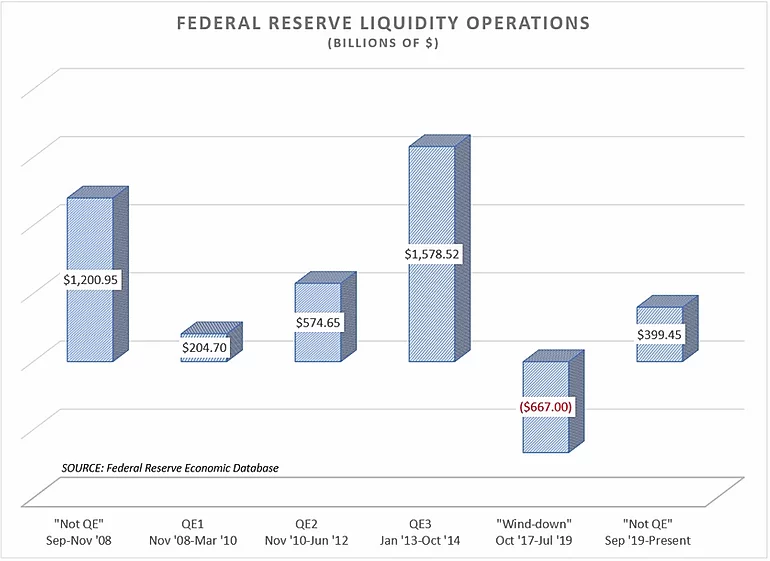

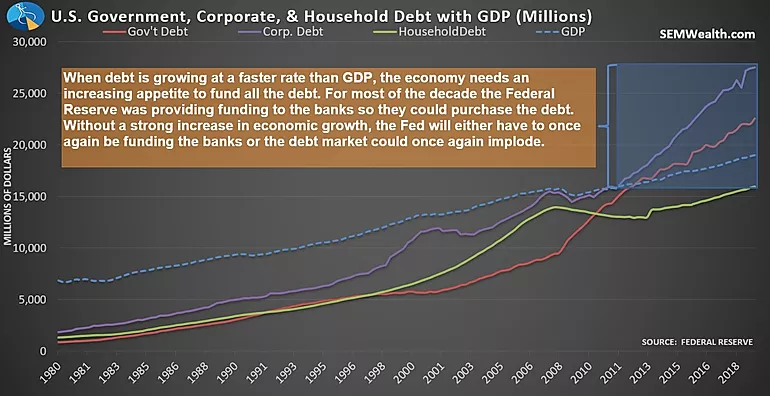

As we start a new decade it appears we will continue to have "unprecedented" measures by the Federal Reserve to keep the markets rising. While the Fed refuses to call the huge influx of cash into the banking system "Quantitative Easing (QE)," the fact the banking system still needs the

I've often told our advisors and clients the calendar can be a cruel thing for investment managers. Everyone focuses on the returns for each month, quarter, or year, which is often skewed by large moves the last few days or weeks of the period. Look at 2018 where a spectacular

There are a lot of things that create bubbles, but the primary driver behind all of them is our emotions. Our brains are programmed to both assume what has happened recently will continue to happen and to only watch for scenarios they believe are possible. I've called this current bull

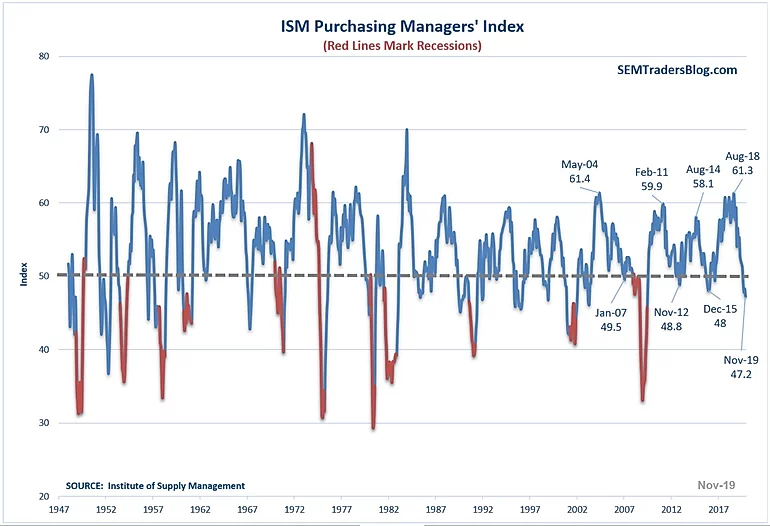

At the beginning of October, I pointed out the sensationalism of the financial media when they pointed out how the ISM Manufacturing Index posted the worst number in 10 years. It was only 0.2 lower than the previous 10 year low. After a rebound in October, the ISM Manufacturing