Unlike the January employment report, the April report did not have any blatant data points that caused a “crash”. With average earnings only rising 0.1% myopic market participants celebrated the lack of wage inflation, hoping this will allow the Fed to take a few more months off

Tag: Chart of the Week

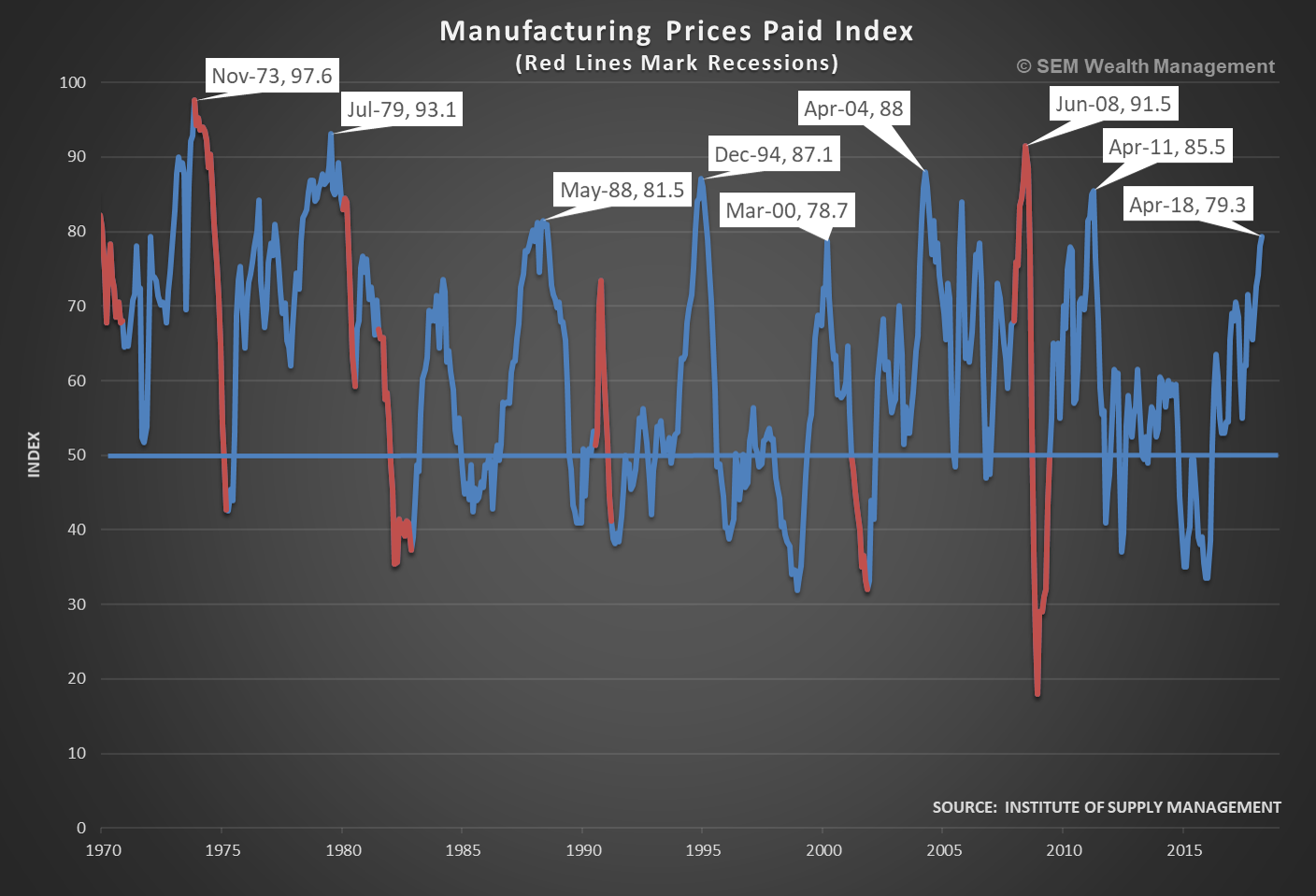

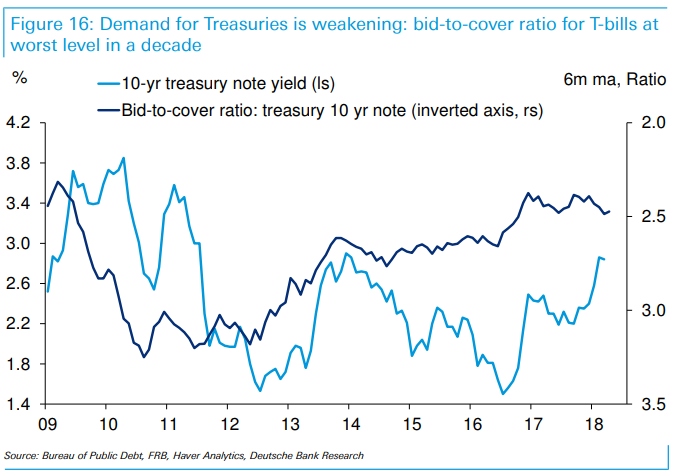

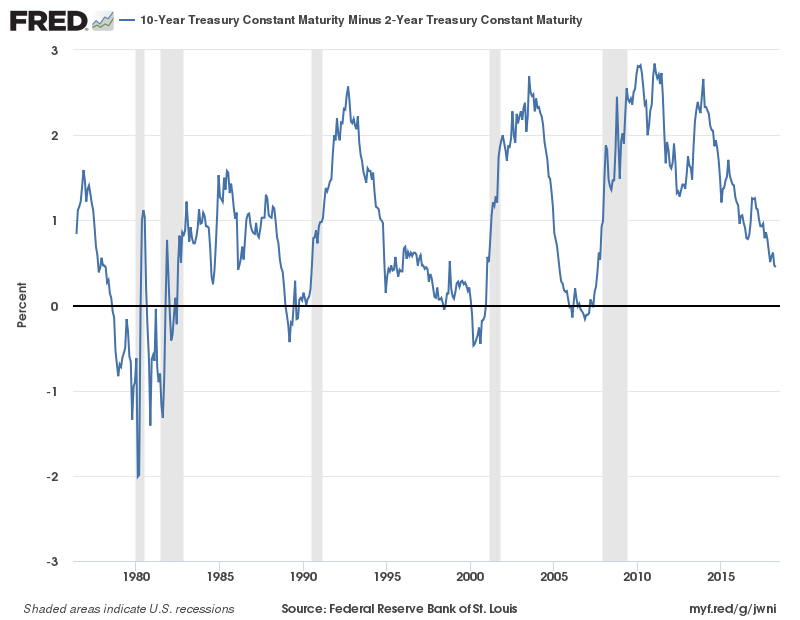

Last week’s Chart of the Week discussed “Conservatism” bias where we tend to fail to incorporate new information into our assessment of the current and future environments. I pointed out the tightening spread between long-term and shorter-term Treasuries as well as the jump in the TED

Conservatism Bias: A belief preservation bias in which people maintain their prior views or forecasts by inadequately incorporating new information. Conservatism causes individuals to overweight initial beliefs about probabilities and outcomes and under-react to new-information; they fail to modify their beliefs and actions to the extent rationally justified by the

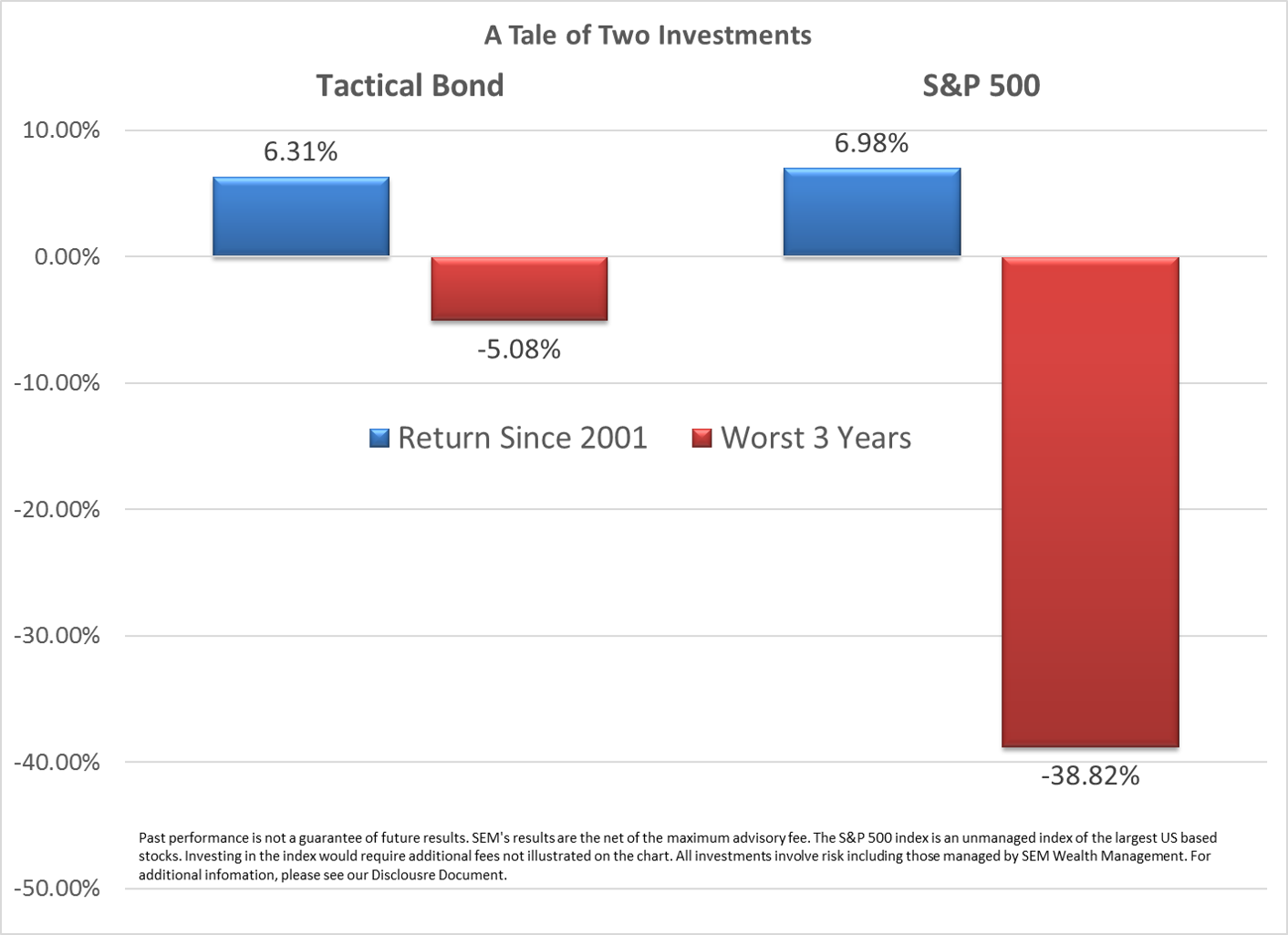

Over the past several years as the S&P 500 has marched steadily higher clients in our lowest risk strategies (Income Allocator & Tactical Bond) have grown anxious. Even though most clients invested in these two programs are there because they either had a very low ability or willingness

One of the most common behavioral biases in humans is “representativeness” bias. As Nobel Prize winning economist Dr. Daniel Kahneman described how our brains our programmed to work it is easy to see why this is the case — our brains are generally lazy and want the easiest,