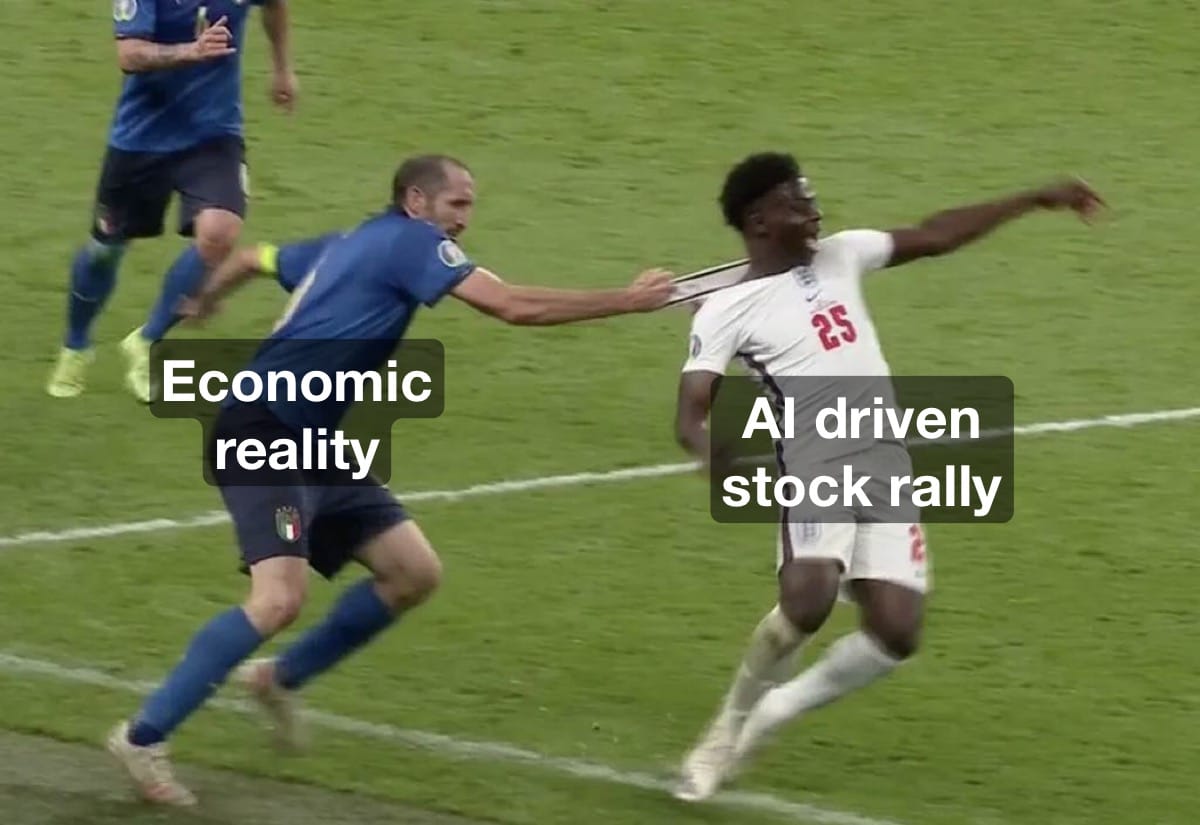

The stock market continues its stampede higher following the re-election of Donald Trump. The assumption is apparently everything will be awesome. I truly hope that is the case, but as I outlined the week after the election, there are several areas where I believe voters, investors, and the President-elect himself

Tag: Economic Update

Election week is finally here. This has literally been the longest presidential election period with Donald Trump essentially running for re-election since 2021 and Joe Biden declaring his intention to run again shortly after taking office. I don't know about anybody else, but I'll be glad to have at least

Friday morning I had CNBC on while I made our twins' breakfast. It was the morning of the jobs report and I wanted to get a feel for the market's reaction. As is often the case one 'expert' would argue how good things are and another 'expert' would state his

A year ago, the stock market was in the midst of a 10% correction over fears the economic data was too strong, which meant the Fed was going to continue in their inflation fight. The sell-off started when the Fed hiked rates after a one meeting pause. The sell-off didn't

Four weeks ago the title of the blog was "Be careful (what you wish for)." At the time bad economic data was viewed as 'good' news for stocks as it meant the Fed was likely to cut interest rates at some point soon. I warned at the time about the