For those of you who have been following along, I've been using this space each Monday to list all the things I thought about over the weekend. It's something I did during the financial crisis and the 2011 "debt ceiling circus/EU debt panic". There's just too much happening to

Tag: Investor Behavior

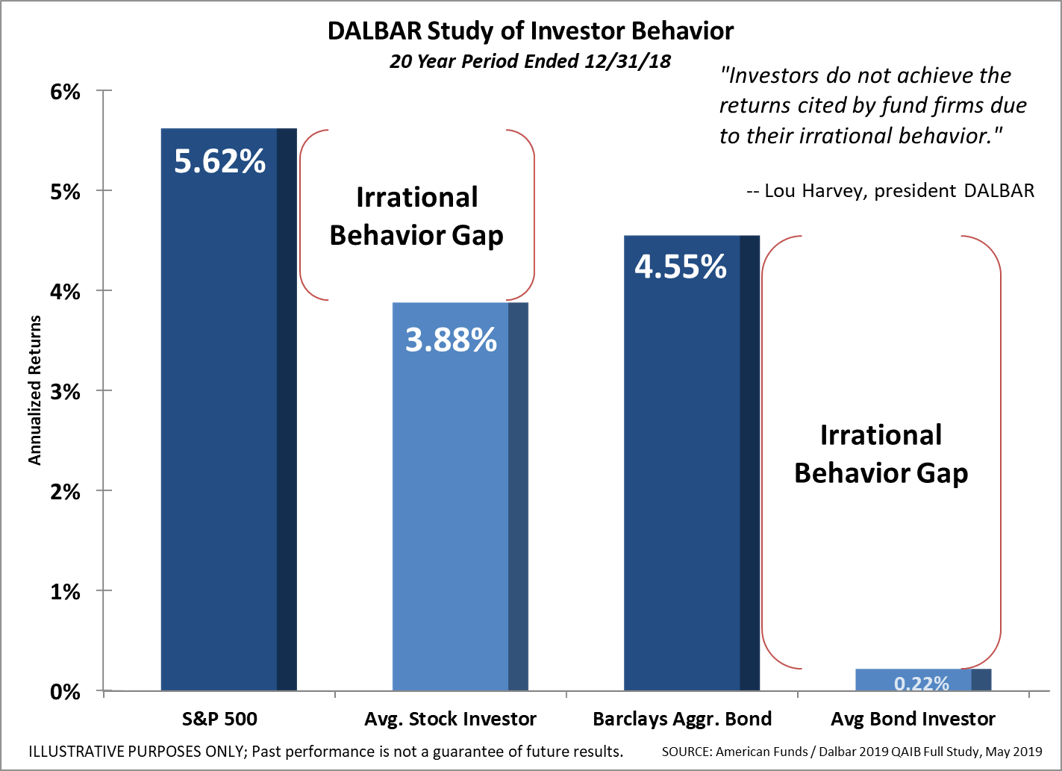

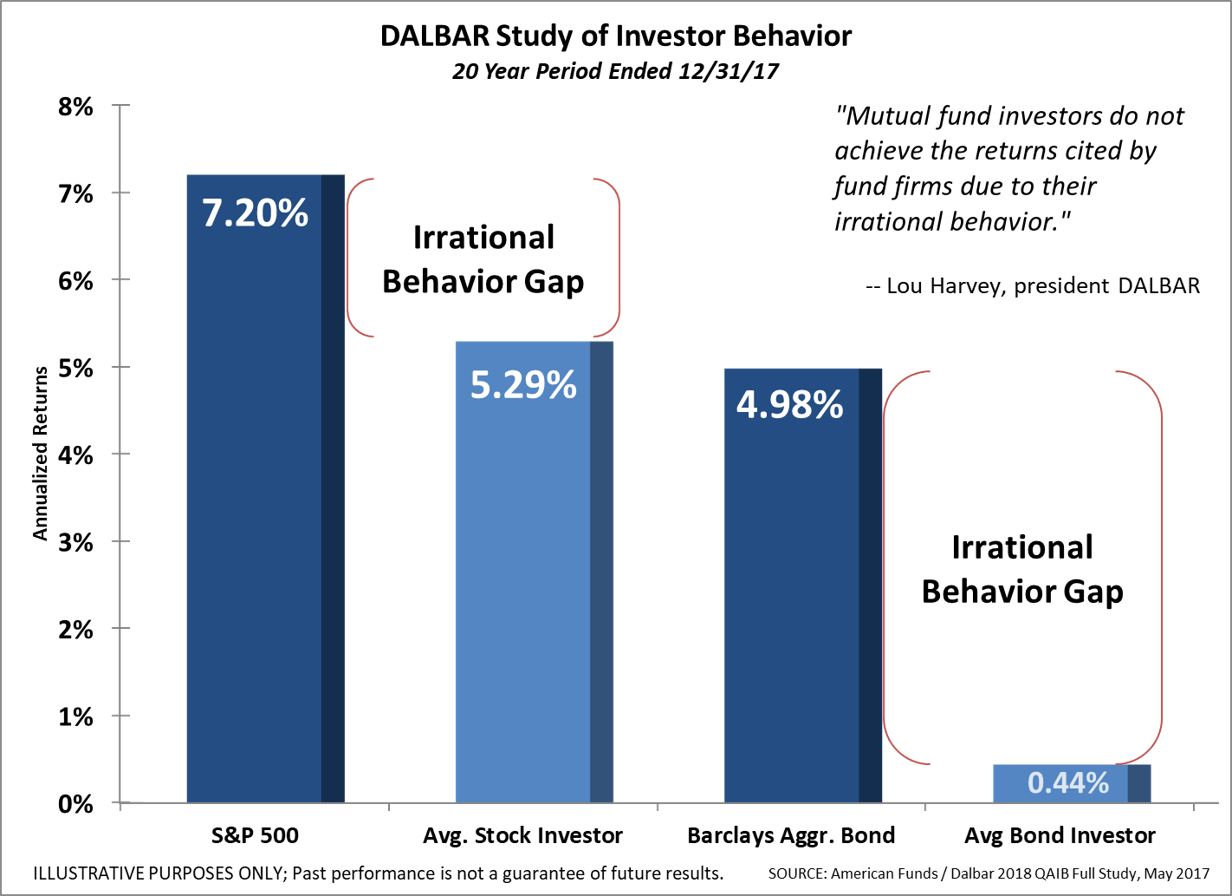

Since our founding 27 years ago, SEM has understood one critical fact — investors are humans, not robots. Each year DALBAR releases the Quantitative Analysis of Investor Behavior (QAIB). They study the buy & sell patterns of stock and bond investors and compare the returns of the average investor to

Jeff was a guest on “Ask the Expert” with Mason & Associates in Norfolk, VA this week. During the show they discussed how the recent Hurricane in North Carolina can be an analogy of how we tend to deal with our investments and savings. In addition, several callers

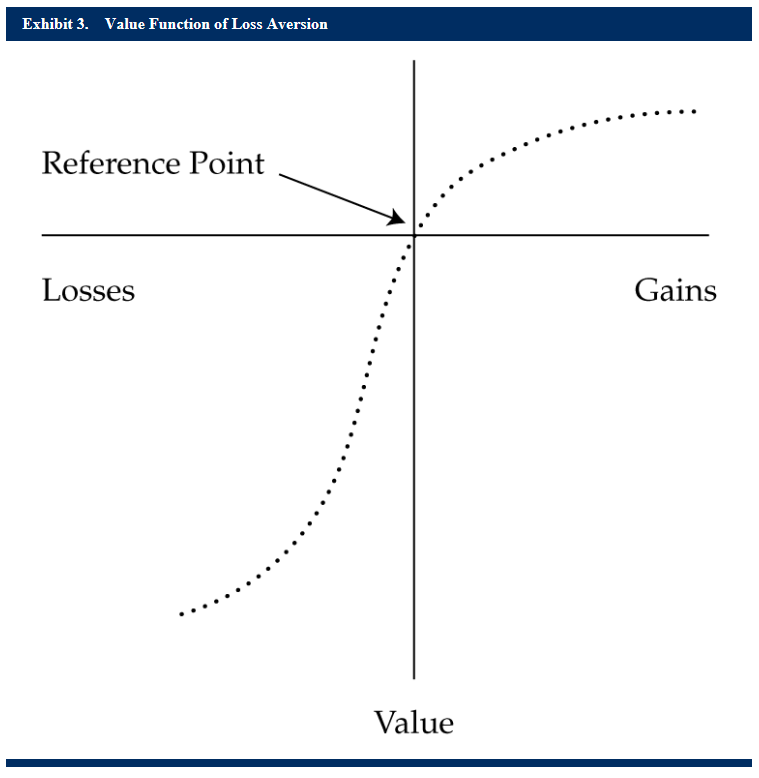

Being human means we are not always completely rational. There is nothing wrong with that. This is what makes life interesting and makes each person unique. If everyone behaved rationally we would have a world full of robots. When it comes to investing, however, our natural human traits can cause

SEM applies a Behavioral Approach to Investing. Our total portfolio approach is designed to overcome the most common behavioral biases. To understand the importance of this we need to first understand the biases. About two years ago I posted a video clip from one of our client seminars where I