For those of you who have been following along, I've been using this space each Monday to list all the things I thought about over the weekend. It's something I did during the financial crisis and the 2011 "debt ceiling circus/EU debt panic". There's just too much happening to

Tag: Tactical Bond

Bad news is good news right now for investors. It seems the uglier the economic data, the more excited they become. The reason, as we cited last week was the belief this will lead to Fed interest rate cuts sooner rather than later. Investors are conditioned to believe anytime the

With the NFL playoffs in full swing our family’s favorite saying is once again in use, “you have one job!” This is most often said about the kickers who continue to miss extra points and short field goals, costing the rest of the team wins in

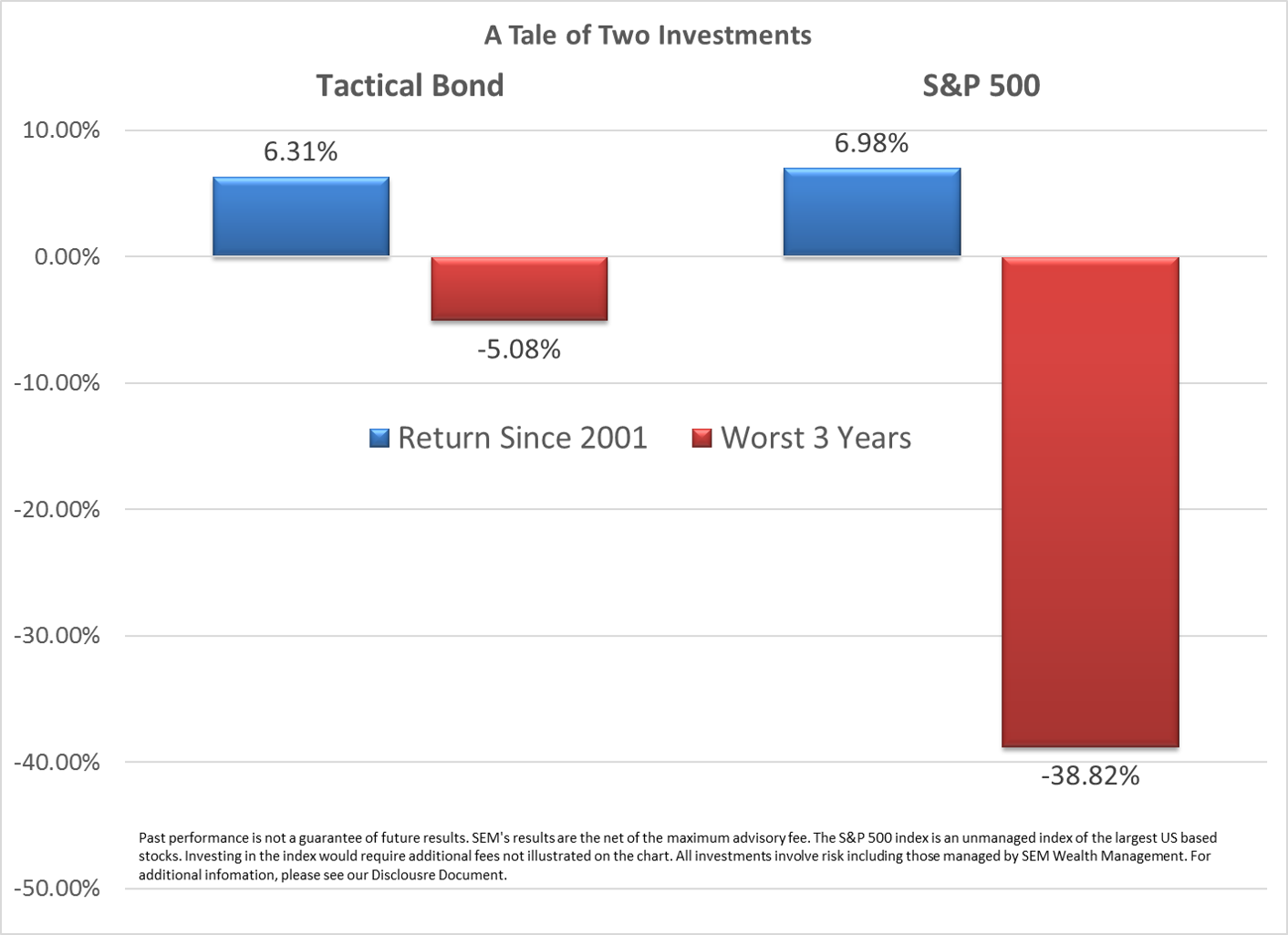

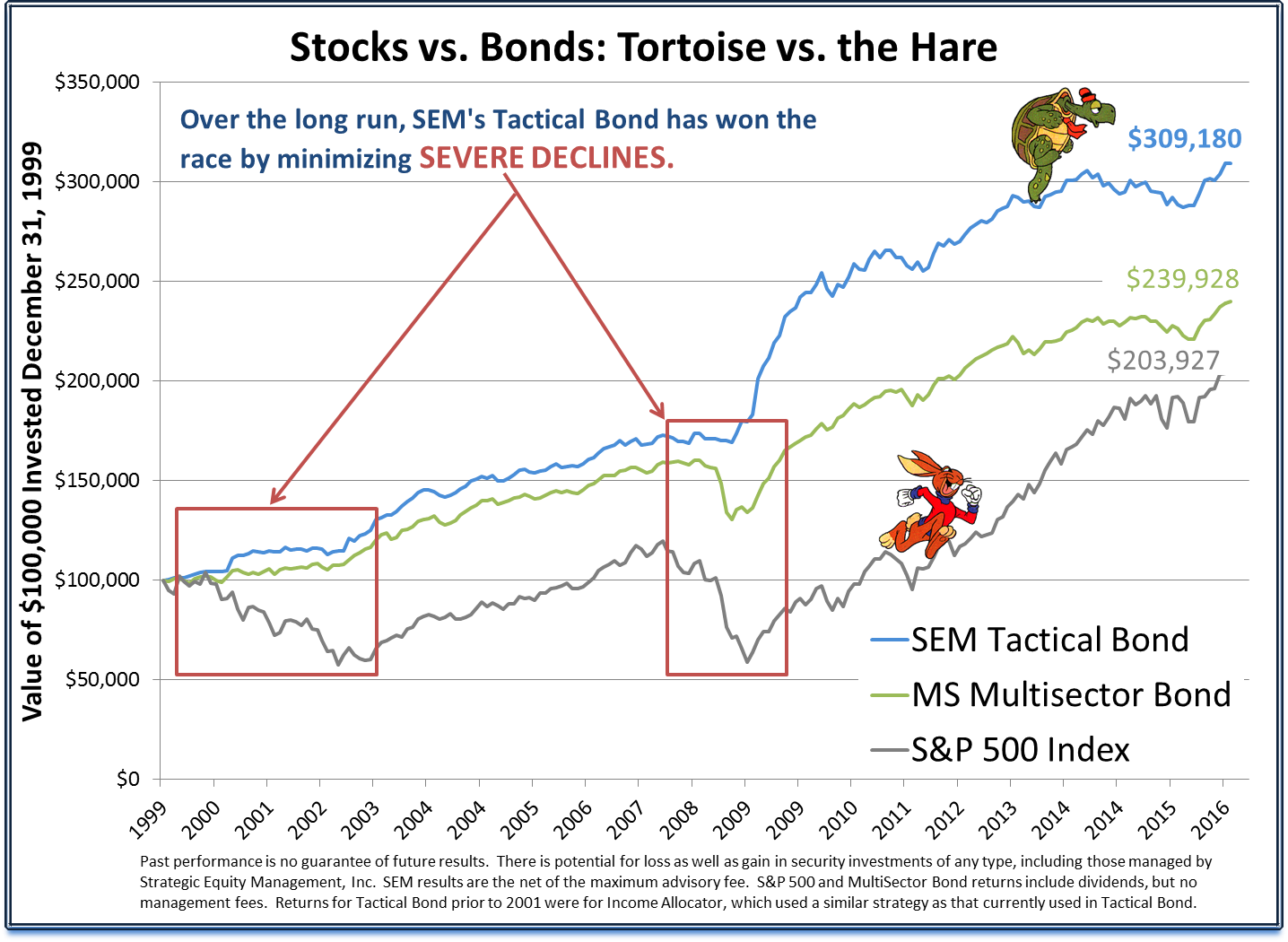

Over the past several years as the S&P 500 has marched steadily higher clients in our lowest risk strategies (Income Allocator & Tactical Bond) have grown anxious. Even though most clients invested in these two programs are there because they either had a very low ability or willingness

Whether it is an objective measurement of a bubble using past valuation levels or our own subjective observation of investor behavior, it is clear we are in some sort of a bubble.

How can you (or your clients) avoid participating in the next market crash?