We're at that point of the year between Christmas and New Year where it's hard to remember what day of the week it is. At SEM where we have advisors across the country it will be a heavy dose of "out of office" messages when we try to contact them

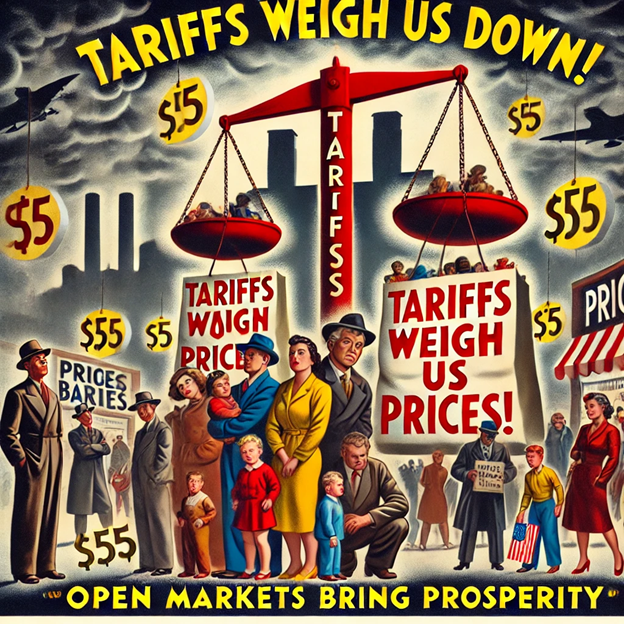

Last week on an advisor call I was recapping my post-election blogs as I discussed: the euphoric post election rally, not letting political opinions influence our investment decisions, valuations and the chances of yet another 20%+ rally in 2025, what tariffs really are and the likely impact on the economy

It always goes in phases, but when there is a long, jaw-dropping run in a single stock and especially stocks inside of one industry we start getting questions from advisors and clients about first investing in the daily headline-making stock, followed by "what do you think is the NEXT (fill

The stock market continues its stampede higher following the re-election of Donald Trump. The assumption is apparently everything will be awesome. I truly hope that is the case, but as I outlined the week after the election, there are several areas where I believe voters, investors, and the President-elect himself

As I've said since the election, there is no point right now trying to predict what will happen over the next year (or four). Based on my inbox, everyone has their predictions. Maybe it's because their marketing people tell them they have to, but based on my experience there is