In the fall of 2019, the banking system froze due to the amount of new debt being auctioned by the Treasury Department to finance the budget deficit. The Federal Reserve had to step in and provide "temporary" emergency funding to save the banking system. At the time, the total issuance

The great COVID experiment has begun. As we enter the 8th week since the US Coronavirus panic began, some states have begun to open back up. While not a controlled experiment with a ton of different variables coming into play, in four weeks we will at least have some data

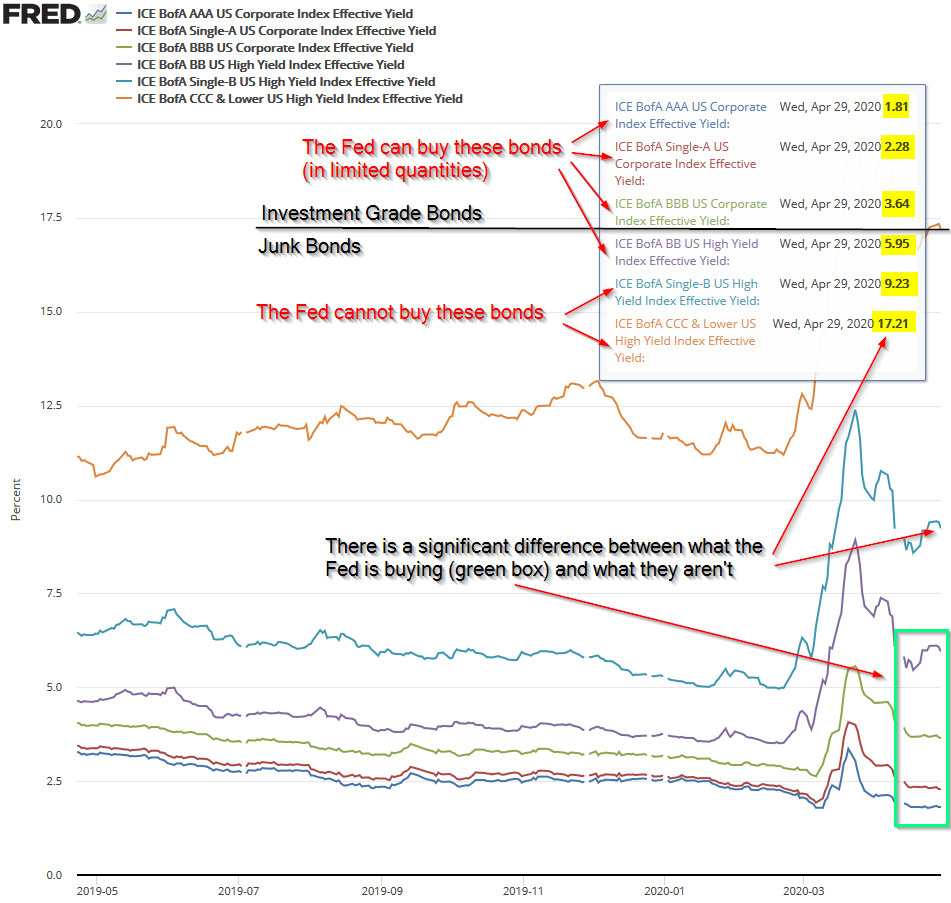

The virtual ink had barely dried on my "time to get excited about valuations" post when the Federal Reserve did what, up until that point, most of us thought would never happen. They announced they would not only be buying junk bonds, but also junk bond ETFs. The spread between

We're starting the 7th week since the country began to shutdown due to the Coronavirus. We continue to see so much confidence in the forecasts from the big name Wall Street investment firms. The consensus is this is just a small bump in a bull market and you should both

For over a decade I've been listening to "experts" recommend investors dump bonds and use dividend paying stocks for the fixed income needs of clients. I've again heard this advice in the past month. This is what I thought of:

For over a decade I've pointed out two