At the end of April the S&P 500 (barely) reached a new all-time high. The next day, Federal Reserve Chairman Jerome Powell mentioned the slowdown in the economy is likely “transitory”, which is Fed-speak for temporary. This seemed to remove the prospects from traders’ minds about a rate

GDP growth surprised nearly everyone in the 1st quarter rising 3.2% in the past year. The president of course pointed to his economic policies as the cause of this “great” increase. Never mind the fact the long-term average growth rate is 3.1%. This has been the

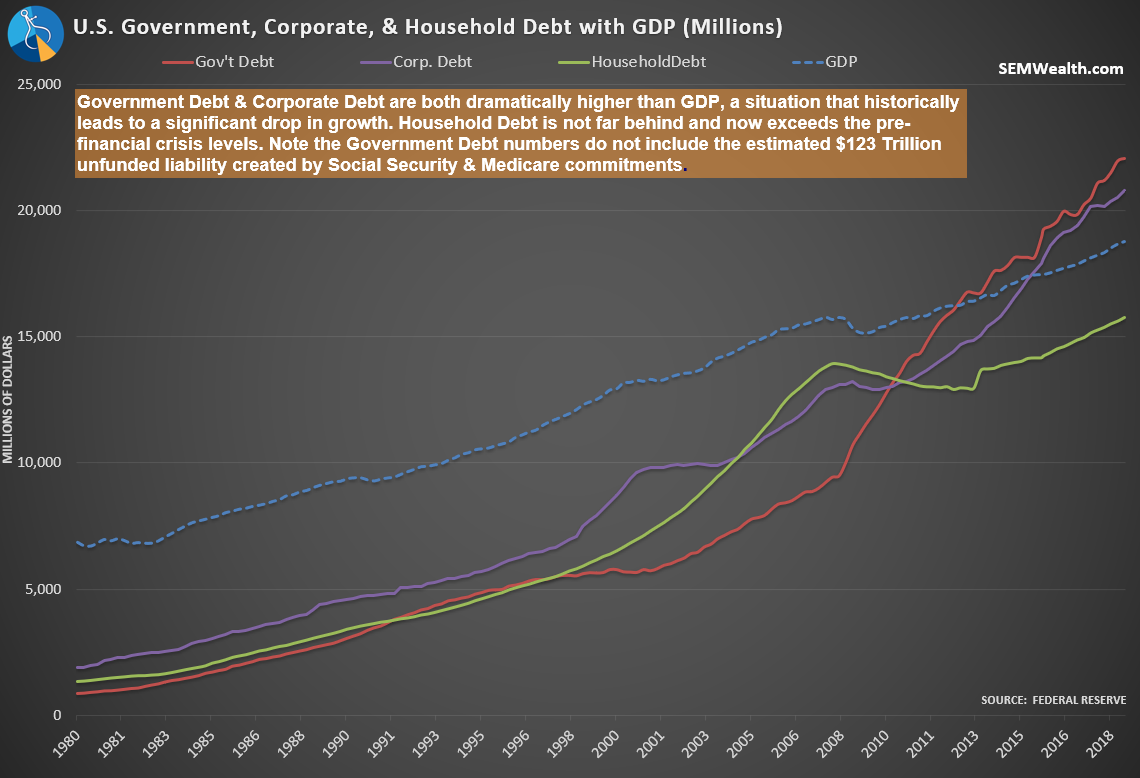

This week the Trustees of the Social Security & Medicare Trust funds released their annual report. They reported under current law Medicare will be insolvent by 2026 and Social Security by 2035. That’s in 7 & 16 years respectively. Their assumptions also include steady 3% economic growth with no

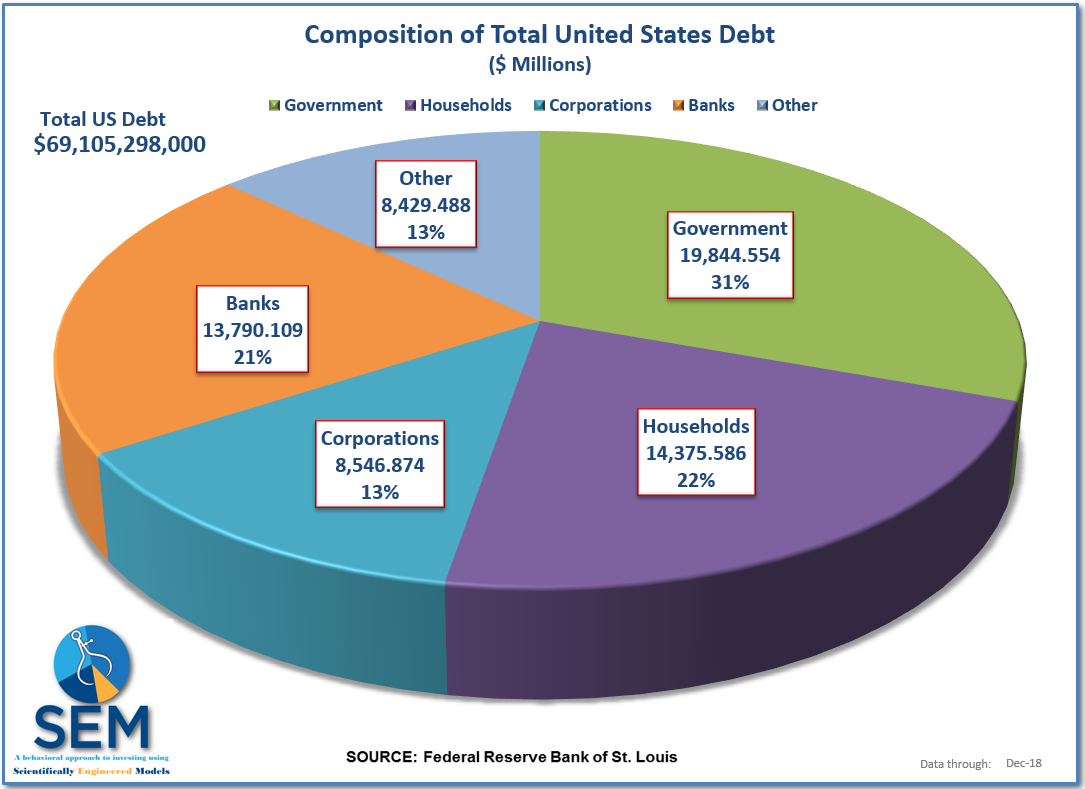

Debt is future spending brought forward. Another way to think about it, debt will hurt future spending. As I was talking to several advisors and clients this week after the end of tax season I couldn’t help but think of our country’s debt problems. Few people want to

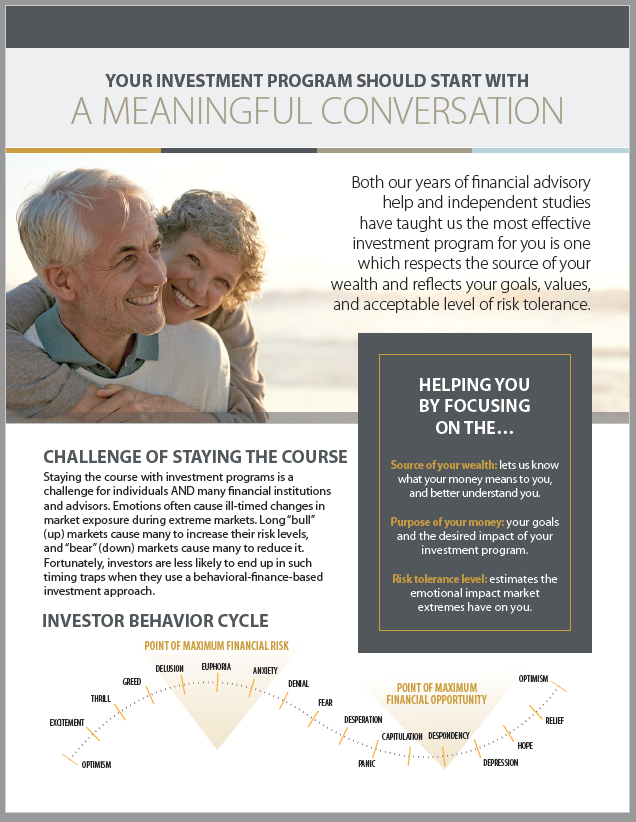

I was quoted in two articles this week. On Sunday, the New York Times published “When Gambling Seems Like a Good Investment“. The article discussed ways financial advisors deal with aggressive clients. It gave me the opportunity to highlight our behavioral approach. In this case, I discussed how