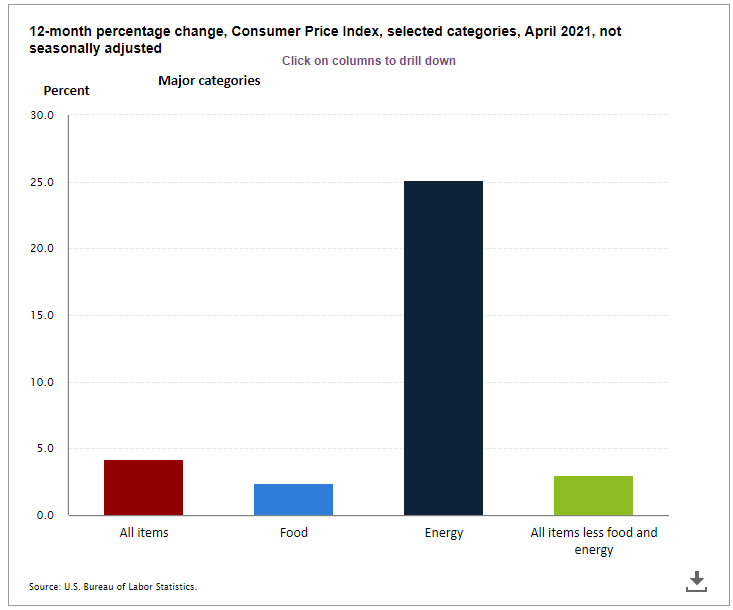

Based on the sensationalized headlines last week, one would think the market was at risk to give back all of its gains. This came on the heels of a much worse than expected inflation number on Wednesday. While "base effects" which is economists speak for what things looked like a

Tag: Chart of the Week

Back in 2019 the daily blog entries turned into a weekly "Chart of the Week". There just weren't a lot of different ways to say what was happening – stocks seemed to go up every week. Any drop of 3% was bought aggressively. Valuations were at levels that indicated long-term returns

Over the past week, the consensus has been built that the US economy is about to embark on a historic boom. The parallel many are using is the Post World War II boom where the government had a "blank check" to rebuild the country's economy. Treasury Secretary Janet Yellen was

Whether when investing or just life in general there are all kinds of things that can go wrong. We can often reduce the damage of those risks, but not all the time. However, it's usually the things we cannot see that hurt us the most.

With most of the country

Most of the country is experiencing the coldest temperatures of the winter, which is fitting given the current state of the economy.

The market is ignoring the current data and focusing on the months ahead. They are fully pricing in a tremendous recovery based on three things:

- Stimulus

- Vaccines

- Federal