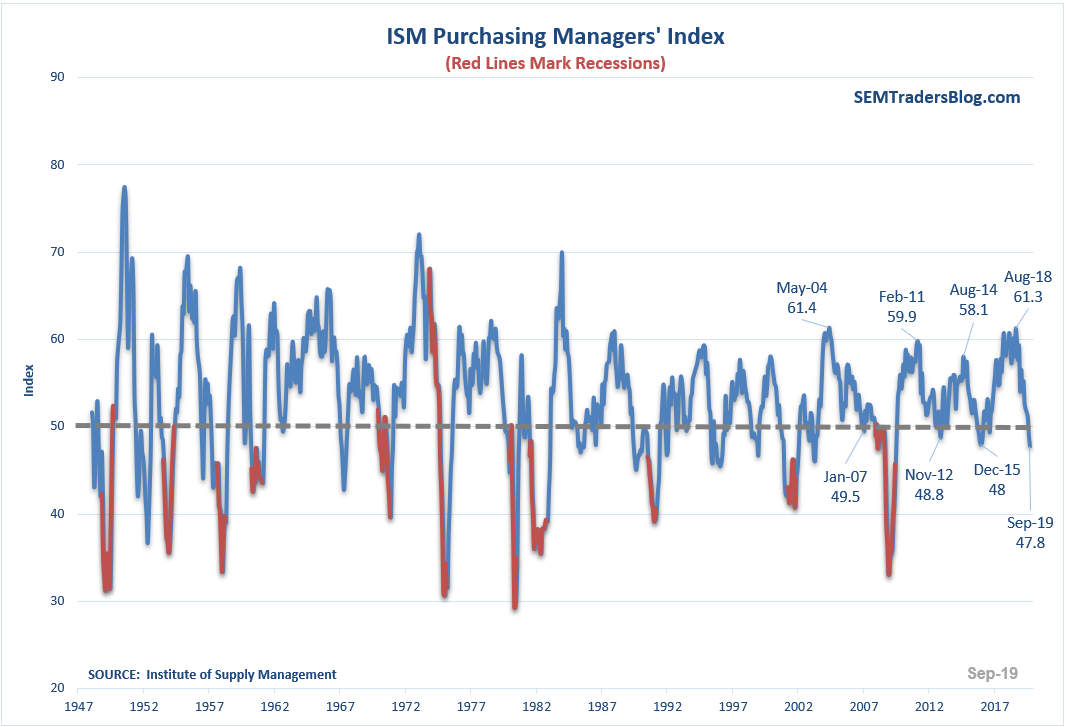

After 25 years of following the financial markets every day, you’d think I’d grow used to the sensationalized headlines of every single market move and every single economic data point. Today the financial media was reminding us that the ISM Manufacturing data released this morning showed

Tag: Economic Update

Last March the markets panicked as the yield curve “inverted”. It inverted once again this week causing a sharp sell-off on Wednesday. An inverted yield curve means short-term interest rates are higher than long-term interest rates. This has long been known as a leading indicator of a recession.

Some pundits have postulated that the President’s “hold my beer” tweet following the Fed’s decision to “only” cut interest rates by 1/4% instead of 1/2% was to force the Fed’s hand into cutting rates much more significantly in

On Tuesday, stocks posted their best single day jump since December. Earlier in the day, the financial media attributed it to a Chinese official saying the trade dispute with the US should be resolved with “talks”, not retaliatory tariffs. Later in the afternoon, the media said the rally

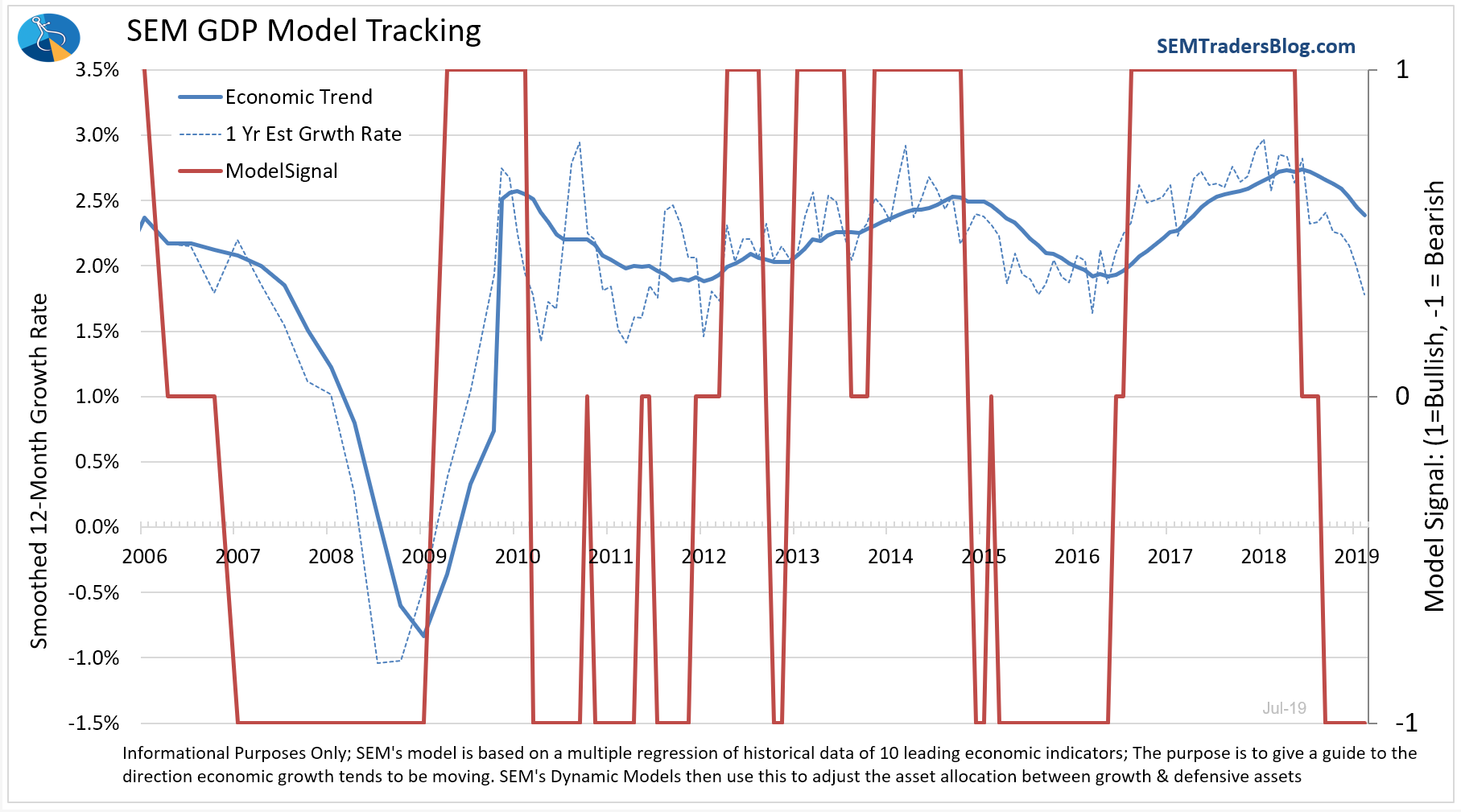

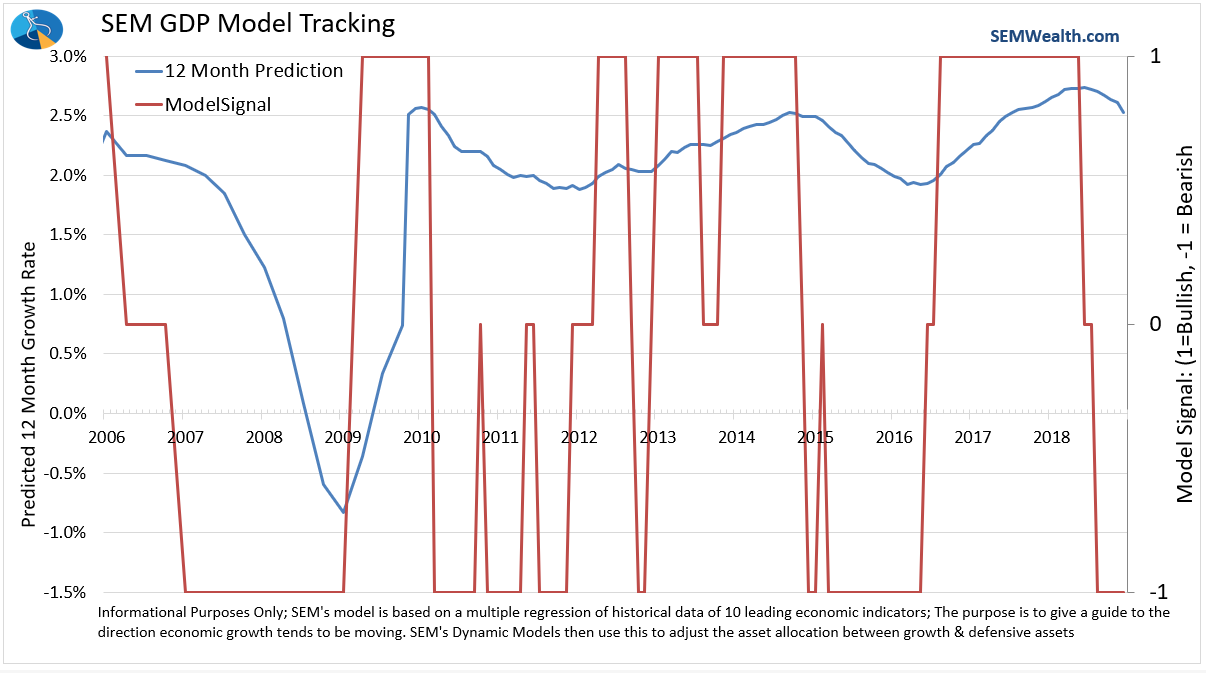

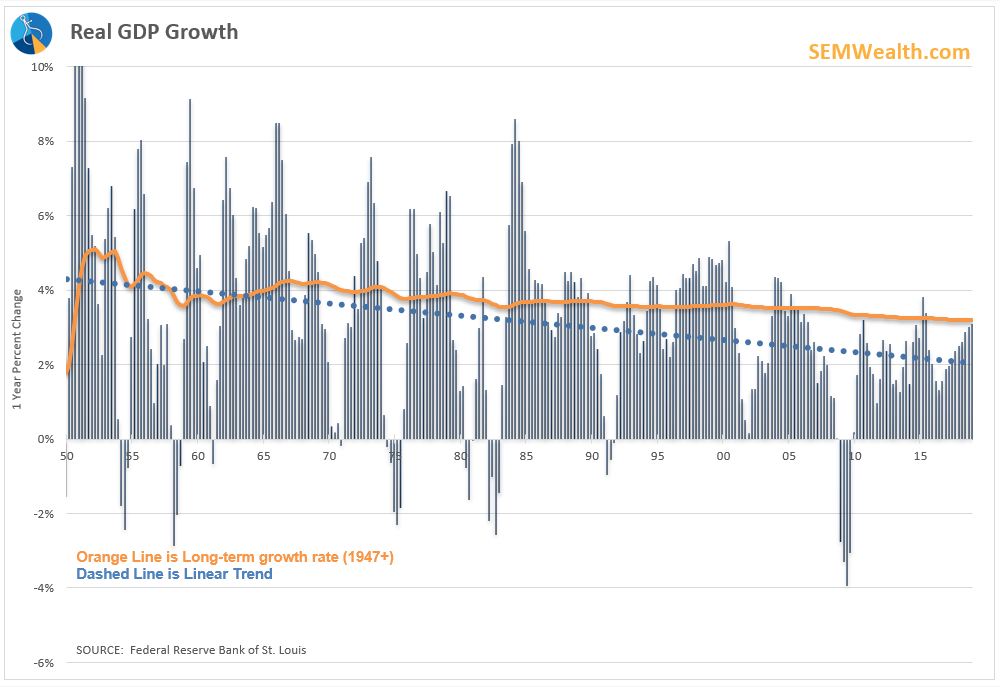

As we edge closer to the longest economic expansion on record, I think most people are expecting some sort of slow down in growth. It’s not the Fed’s fault as one popular Twitter user likes to point out, but rather an economic fact that simply cannot