Last week we learned inflation is running at the highest annualized rate since 1982. This led one Federal Reserve President (James Bullard of St. Louis) to say he will push to increase interest rates up 1% by July. Wall Street quickly upped their expectations for Fed Rate hikes to include

Tag: Interest Rates

"The Fed controls short-term rates. The free market controls long-term rates. If the free market decides rates should be higher, they will go higher."

This is something I've said often since 2008. Most people believe the Fed can do whatever they want with interest rates. That is simply not true.

It's been exactly a year since investors woke up to the possibility that COVID19 could disrupt the "rocket ship" economy most believed we were experiencing. Investors saw little chance for anything to interrupt it. Readers of this blog and investors with SEM would have known the economy was artificially juiced

Is it possible for the last 10 weeks to have flown by, but also to feel like the longest 10 weeks of your life? The last 10 weeks have been a whirlwind and have had seemingly inconceivable developments every single day. At the same time, they've also felt like this:

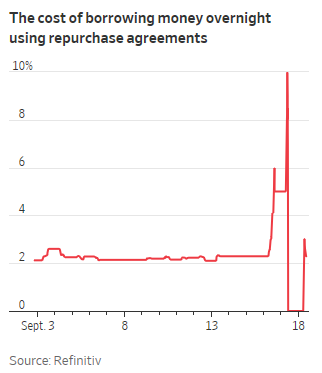

You can only manipulate the financial system so much without causing a large disconnect in the free market. This week we briefly saw what can happen when too many people want to get cash out of a system the Federal Reserve has been micro-managing while trying to stimulate economic growth.