A lot of data hit last week on both the earnings and the economic front. We have even more data coming this week along with a Fed meeting. Interest rates on 10-year Treasuries crossed 5%. The S&P 500 is now down 10% from its most recent high. Add

Tag: Musings

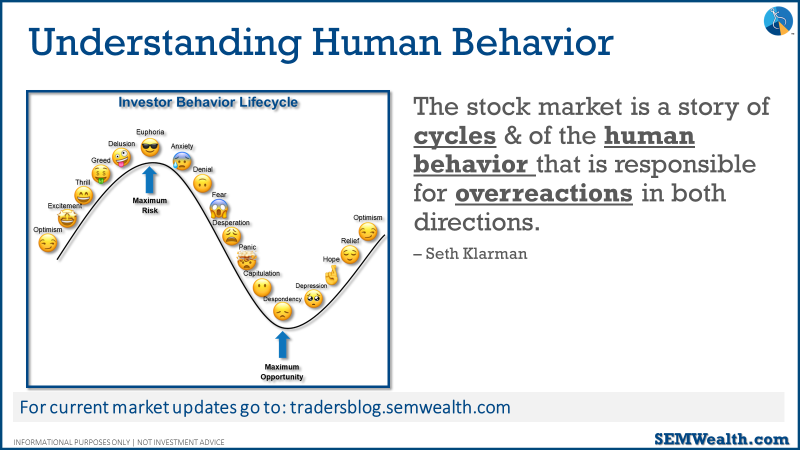

The market moves in cycles of excessive optimism and excessive pessimism. I start out nearly every presentation with this slide:

This is important to understand if you watch the markets closely. It is easy to get sucked into the current narrative which conveniently always is designed to support the current

A lot has been made about the losses in bonds over the past 3 years. Researchers from Bank of America obtained bond market data all the way back to 1787 and found there has never been a 3 year period with this large of a drop in Treasury Bonds. As

I've spent a lot of time the past few months discussing the way our brains work and how that is impacting our assessment of the current environment. Our role here is to use data to help us focus on what matters and what is just a bunch of noise. I

With powerful computers always in our hands, and any and all information sources available on any of the screens at our disposal, it's easy to overreact to every piece of information. Whether it is politics, the weather, the latest violence in your region, the economy, or the stock market, we