The stock market is back to its highest levels since early February. 10-year bond yields have climbed 1% since the start of the year and are at the highest level since early 2019. Last week we asked who was right – stock or bond traders. The stock market believes the Fed

Tag: Valuations

"Don't fight the Fed" - Marty Zweig

Marty Zweig was a famous investment advisor and stock trader for his disciplined approach. This approach helped him warn clients about both the 1987 crash as well as the bursting of the tech bubble. His book, "Winning on Wall Street" contained a list

The shorter work week didn’t allow us much time to get new news that would point the market in a certain direction, but the market didn’t stay flat. We are at a point, like we’ve been mentioning quite often lately, that the market NEEDS positivity to continue

Last week, I mentioned being cautious about reading into market moves over the summer. It doesn't mean we can't completely ignore what is happening. Losses are losses and gains are gains. I highlighted 3 Themes that are worth watching. This week, the market is conflicted with two of the themes

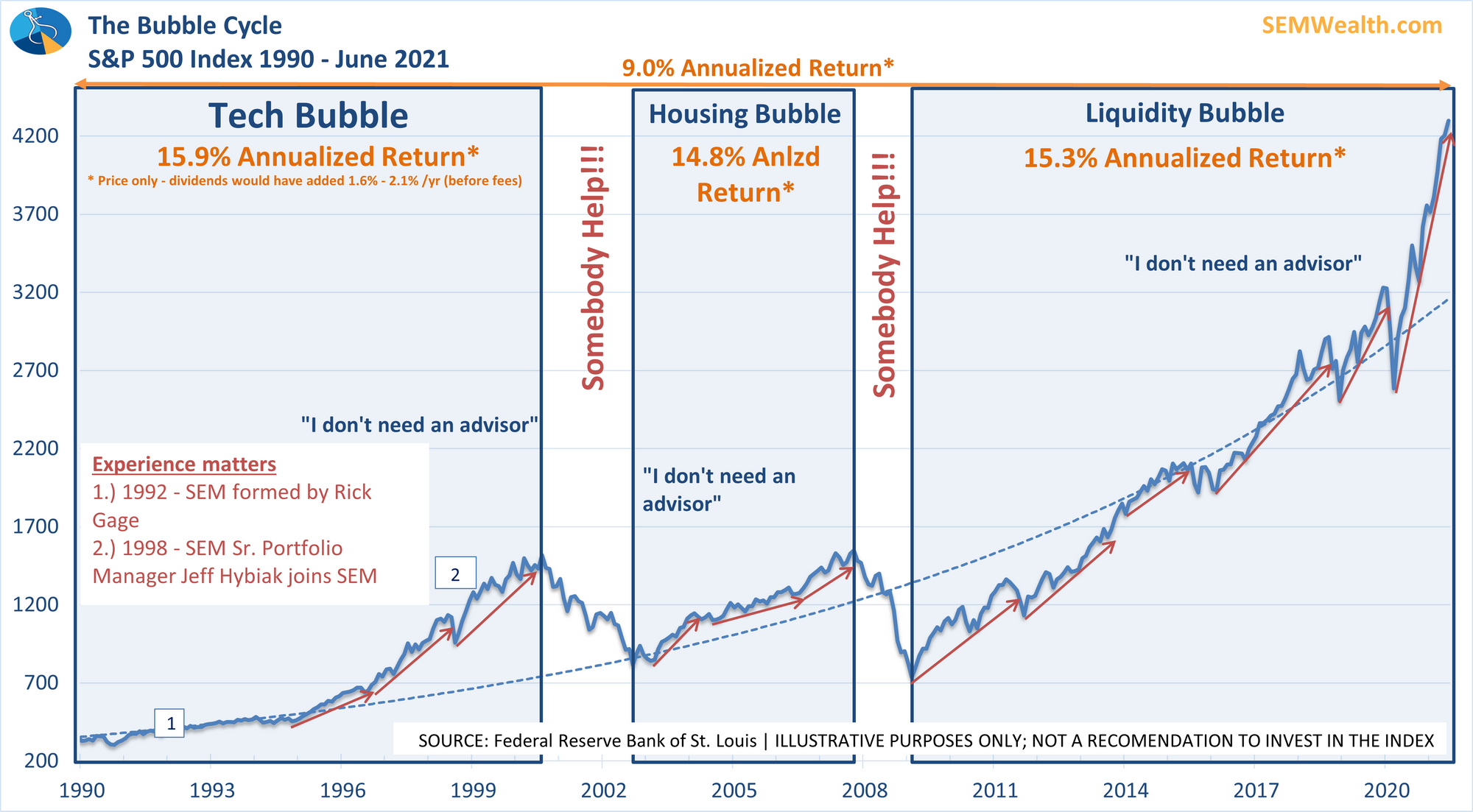

Back in 2019 the daily blog entries turned into a weekly "Chart of the Week". There just weren't a lot of different ways to say what was happening – stocks seemed to go up every week. Any drop of 3% was bought aggressively. Valuations were at levels that indicated long-term returns