Probably one of the most frustrating things for me after 25 years of managing investments is how inefficient the market is at pricing in reality. This leads to far too many people getting sucked into the wrong investments.

Last week we've again witnessed two examples of the inefficiency of the markets. The first is Netflix, which is now 64% lower than it was on January 1. Yes, they reported a decline in subscribers, but that shouldn't be a surprise to anybody with common sense who uses their services. Is Netflix really worth 64% less than it was at the beginning of the year (and 1/3 what it was worth to start the week) or was Netflix massively overpriced at the end of the year and sucked in a lot of people who now have lost a ton of money "investing" in their stock?

(Not a recommendation to buy or sell, but my guess is the answer is probably somewhere in between.)

The other example is the stock market overall. Since January the Federal Reserve has been saying, "we're going to have to raise interest rates a bunch to slow inflation down." They told us the same thing in February and March. Thursday morning the Federal Reserve Chair said the same thing. Since those remarks, the S&P 500 has lost 5% (and counting). Did the value of stocks suddenly change in 48 hours or were stocks massively overpriced in early January?

(Not a recommendation to buy or sell, but my guess is the answer is probably somewhere in between.)

The moral of the story is if you are trying to use logic to buy and sell stocks over short periods of time, you are essentially gambling. Without an unemotional, data driven system in place you are wagering that your opinion is right and the person on the other side of the trade is wrong. Your logic may not be the same logic as the markets.

Readers of this blog should not have been surprised. We've been warning about this all year. More on this below, after the weekly talking points.....

Weekly Talking Points

- Inflation is likely nearing a peak, but the long-term impact on growth is likely to be a drag for the next 9-12 months. The real risk is a.) prolonged inflation and b.) how much growth slows over this time.

- The economy is going to be forced to stand on its own (Fed is pulling back stimulus and no hope for stimulus checks from Congress), which increases the chance of a recession in late 2022/early 2023. On average the stock market loses 35-50% just before and during a recession.

- In the short-term euphoria could drive stocks higher. This should be used as an opportunity to reduce risk for investors with a time horizon of less than 10 years and/or those who jumped into stocks in 2021 simply to "make more money".

- Your investments should align with your financial plan, cash flow strategy, investment objectives, risk tolerance, and overall investment personality. If you are already in alignment with those items, SEM's models have already taken the steps to adjust to what could be a very difficult environment.

- Even with SEM's models, the expectation should be for lower returns until the still euphoric market prices adjust to the reality of lower growth ahead. Our goal during these times is to lose as little as possible within each model's mandate, so we can pounce when it is easier. Remember, when it feels the worst will be the point of maximum opportunity. Our data-driven models are designed to invest when it feels the worst and to act well before most investors are even aware a bottom has been put in.

I'm thankful for our data-driven approach which does not rely on my opinions to adjust our investment allocations (or anybody else's). I read a lot of analyst reports, study market history, and look at countless data points, charts, etc. Throughout my 25+ years of doing this I've often been right about my big picture outlooks. The problem is I'm often a year, two years, 5 years, or in the case of me leaving the banking industry to join SEM in 1998, 10 years early (in my prediction banks were going to run into major issues.) When you're managing money, being right but 1-2 years early unfortunately means you will not have any money to manage.

This blog is designed to give our advisors, clients, and any interested investors a very big picture view of what we see. We will also sprinkle in any changes to our quantitative trading systems to give an idea of how they are adapting. The purpose of this is to allow readers to make better decisions. This weekend I scrolled back through the "musings" for the year.

January 3: New Year, Same Concerns (inflation, Fed, and ability of economy to stand on its own)

January 10: Should we fight the Fed? (They just told us they will be raising rates)

January 18: Corrections are inevitable (small ones happen frequently; we're do for a much larger one)

January 24: Time to panic? (S&P 500 was at 4400--this is a new environment for most investors; focus needs to be on financial plan and whether or not you're taking too much risk)

January 31: The bounding ball (large drops are followed by big bounces – be careful to not be fooled)

February 7: A long year (with high valuations, the Fed saying they are raising interest, and unprecedented stimulus investors could be facing the toughest year in their memories.)

February 14: What are they afraid of? (Inflation continues to accelerate and long-term bonds are frantically moving higher, yet the Fed has not implemented any policies to stop it)

February 21: A game of chicken (week of Russia invasion of Ukraine; there could be unforeseen consequences from this conflict, such as structural increases in inflation due to the impact it will have on commodities; this makes it even harder for the Fed.)

February 28: Nobody knows (all the 'experts' telling us how the Russia-Ukraine war will play out and what the impact will be on politics, the economy, and the markets have zero idea and we should avoid listening to them.)

March 7: Collateral damage (continued discussion of the Russia-Ukraine conflict as well as how inflation is becoming a much bigger problem for the slow-moving Fed.)

March 14: No easy solutions (deeper look at the economic impact of the Russia-Ukraine impact on commodities and how it potentially will keep inflation high; on-going look at economic data showing the early days of a possible slowdown)

March 21: Who is right? (the stock market (at the time) was saying there is little risk of an economic slowdown; the bond market was/is saying there is a major risk of inflation causing major problems in the financial markets. Who should you listen to?)

March 28: Patience is key (focusing on the day-to-day moves prevents us from looking at the big picture. The market will have large swings on a day-to-day basis which could cause us to believe there are no risks (or major risks); We need to let the cycle play out.)

April 4: Spring of deception? (S&P 500 was at 4600 – does the big rally mean the risks are over or are we about to be smacked with another round of 'winter'? Our economic model turned bearish – includes a deep look at all of our leading indicators inside the model.)

April 11: Should we trust the Fed? (Too many people believe the Fed is a) all knowing and b) able to stop a recession/protect the stock market; An honest look at history tells us they are typically woefully slow – they keep policies easy for too long, creating large asset bubbles & then tighten too far, causing large corrections.)

April 18: A drag on growth (inflation and spikes in long-term interest rates are already slowing growth, but the Fed is still doing nothing to address it; the bigger problem is the heavy use of debt, a continued decline in our labor force, and little improvement in productivity; Big names in the industry are telling us to lower our expectations for average 10-year returns — until we see a correction in stock and bond valuations.)

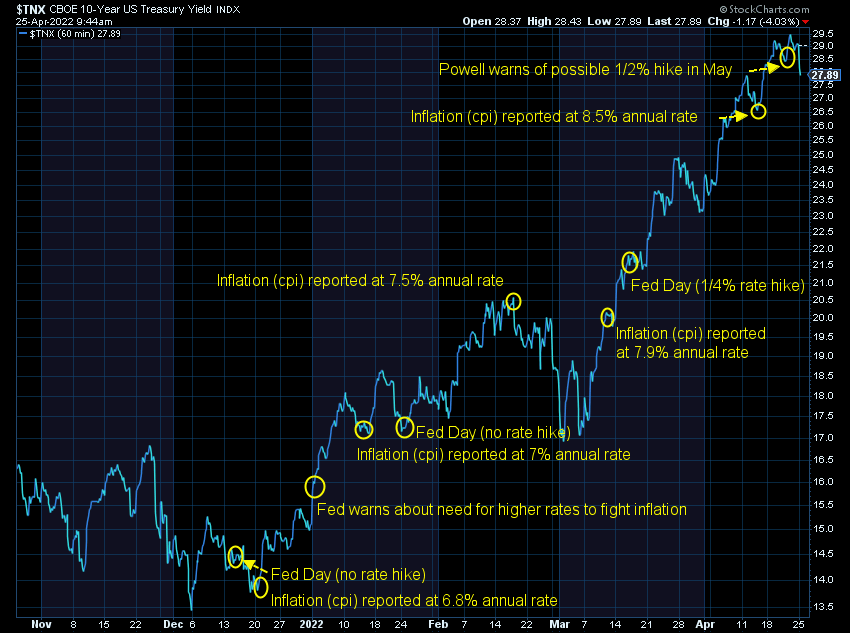

I think the above speaks for itself. I'll add a few updated charts. First, the bond market is continuing to tell us inflation is a problem. As I said back on March 21, I trust the bond market much more than I trust the stock market. Since interest rates hit an intermediate-term bottom at 1.3% in December, we've seen 5 inflation reports with numbers at 6.8% and higher. We've had 3 Fed meetings during that time, and they have only raised rates by 0.25%. They also continued to buy Treasury Bonds from Wall Street banks (Quantitative Easing) up until last month.

The stock market has been a completely different story. I added some yellow lines to mark the S&P 500 level during the past two Fed meeting days. We are now slightly below where we were when the Fed finally raised rates back in March.

Stocks have dropped 13% since the Fed told us they would begin raising rates to fight inflation.

Throughout what I think we could call the post-2009 "everything bubble" many people were lured into believing "it's different this time!" People honestly believed the Federal Reserve (and Congress) would never allow a recession/bear market to happen again. The so-called "Fed put" seemed to come into play whenever the stock market lost 15%. The unprecedented joint action by the Fed and Congress cemented in many people's brains this belief and it led to even greater risk taking. If you believe the Fed and Congress will bailout the markets, why not take on a ton of risk.

[A "put" option is a derivative instrument you can buy to protect an investment from losses below a certain point. While there wasn't any real "put" applied by the Fed, the thought in the markets based on past Fed actions was they would only tolerate a 15% drop in stocks before changing course.]

Now the markets are close to being down 15% and the Fed has barely begun tightening. The "Fed put" is not anywhere close to being in play. This logic has created massive excesses that must be removed. It's never different this time.

Sooner or later, the free market takes care of the excesses. When they do it is often scary if you don't have a plan in place to not only protect money that needs protected (for instance money being used during retirement), but also to take advantage of the big disconnects that are always created during the panic period.